News

Have We Reached the Bottom of the UK Commercial Real Estate Market?

Why Now Might Be the Most Strategic Moment to Act in Offices and Retail

After two years of capital value declines, risk repricing, and widespread market uncertainty, asset managers and investors are starting to ask a critical question: Have we reached the bottom of the UK commercial property market?

At PRE Chartered Surveyors, we’re seeing a shift in sentiment that suggests we might be approaching a pivotal turning point. Enquiries across our core services — Measurement, Building Consultancy, Project Management, and Sustainability — have risen significantly in Q1 and Q2 2025 compared to 2024.

Investors are re-engaging, not only with prime markets but also with previously more uncertain sectors like offices and retail. They’re looking for clear, fact-based signals that the tide has turned, and increasingly, those signals are getting harder to ignore.

Interest Rates Are Easing — Unlocking Confidence

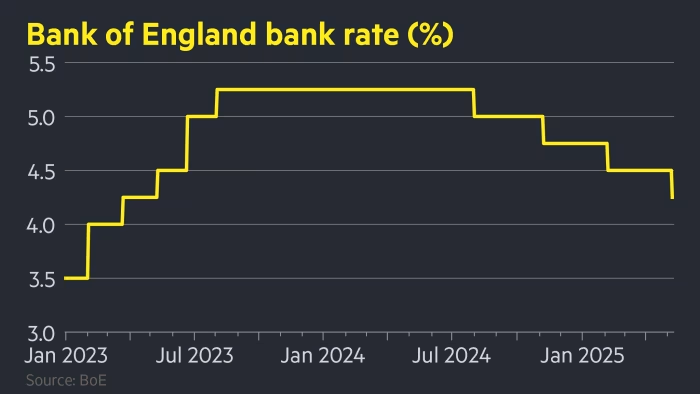

Perhaps the strongest tailwind is the shift in the interest rate environment.

Earlier this month, the Bank of England reduced the base rate from 4.5% to 4.25%, marking the fourth consecutive cut since Q3 2024. This is a pivotal moment. With further cuts expected throughout 2025, borrowing is set to become increasingly affordable — restoring deal viability and pricing power to leveraged investors.

Why does this matter for the commercial property market?

- Cheaper capital reduces debt costs and improves net returns.

- Reduced uncertainty in the cost of funds, encouraging long-term planning and strategic acquisitions.

- Liquidity is returning, especially to the mid-market where rising financing costs had slowed activity, and many deals had previously stalled.

Commercial Yields: Have They Found a Floor?

Yield movement is another key barometer of investor sentiment and asset repricing. According to our conversations with clients, current yields are:

- Prime London offices: 5.0%–5.25%

- Regional offices: 6.25%–6.75%

- High street retail: 6.5%–7.0%

- Retail warehouse yields: ~25%

This softening of yields, after a period of sharp outward movement points to a period of market stabilisation.

Green Shoots: Signs of Stabilisation in the Data?

The latest market data is also beginning to paint a more optimistic picture:

- InMarch 2025, capital values rose by 3%, and rental values increased by 0.4%.

- Theretail sector saw a total return of 0%, while offices delivered 0.7%.

- Investment volumes forQ1 2025 were up 16% year-on-year.

These positive indicators suggest early recovery across core sectors and increasing market momentum.

Sector Watch – Where Are The Opportunities?

Offices: Resilience Through Repositioning

While the office market has faced its share of challenges, bifurcation is clear. Grade A, ESG-compliant offices in well-connected locations remain in strong demand. Meanwhile, secondary and tertiary stock is under pressure but presents opportunity for repositioning and value-add strategies.

Retail: Value Emerges from a Rebased Sector

Retail is showing signs of reinvention. Retail warehousing in particular is in demand, while high street locations are benefitting from urban regeneration, and resilient tenants are helping drive stable returns.

What to Watch Next

For asset managers looking to stay ahead, these indicators will be key:

- Future movements and direction of interest rates

- Occupier sentiment and lease activity

- ESG and capex requirements

- Supply-side constraints in core markets

Conclusion: A Generational Buying Window?

Timing the bottom of the market is always a challenge — but signs are pointing to a strategic moment for action. With interest rates falling, yields stabilising, and sentiment improving, buyers who move decisively may benefit from favourable pricing and long-term upside.

How PRE Chartered Surveyors Can Help

As market activity builds, ensuring assets are market-ready is essential. Our multi-disciplinary team provides reliable, insight-led advice and fast turnaround across all key areas. We offer a one-stop shop for:

- Area Measurement Reports

- Building Condition Surveys

- Mechanical & Electrical Assessments

- EPCs and Net Zero Pathway Reports

- Environmental Due Diligence

Whether you’re preparing an asset for acquisition or disposal, or just need clear, strategic advice — we’re here to help.

📍 Contact us to discuss your next project

*All figures accurate as of May 2025. This article is for informational purposes only and does not constitute investment advice.*