NET ZERO CARBON – SCOPE AND DEFINITION

UK Green Building Council:

“Carbon emissions from its operation, including occupant activity, are net zero on an annual basis. A net zero carbon building is highly energy efficient and powered from on-site and off-site renewable energy sources, with any remaining carbon balance offset”.

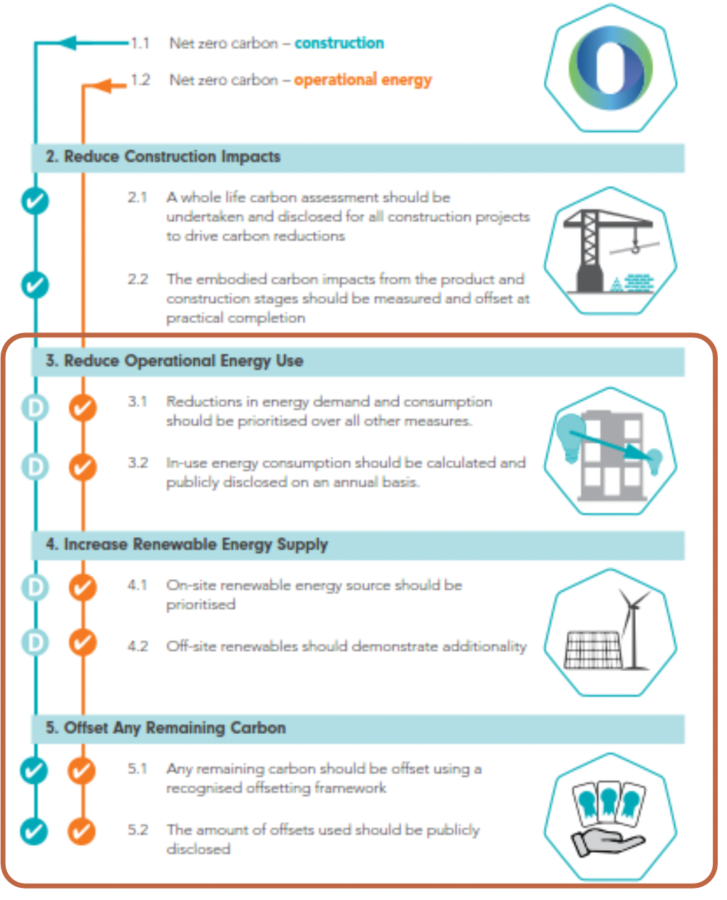

This Framework, as shown below, outlines a hierarchy to minimise energy demand and carbon emissions. The asset has been assessed under Net Zero Carbon – Operational Energy scope. The scope of the assessment is defined as “all areas under operational control that have been used to demonstrate a net zero balance”.

The four main stages of the Framework (operational) are as follows:

- As a priority, the building needs to reduce the operational energy demand as far as possible through a fabric first approach.

- The building also needs to incorporate efficient services and low carbon systems including HVAC and lighting.

- Where feasible and space allows, on-site renewable energy should be maximised, such as through on-site solar PVs.

- As a last resort, minimum carbon offsets can be used for the remaining carbon to achieve NZC. Offsetting schemes need to be procured directly or via recognised schemes including Gold standard to demonstrate additionality.

Carbon Risk Real Estate Monitor (CRREM)

“Reducing the EU carbon footprint will require refurbishment in the existing buildings, but some of the assets retrofitting will not be financially viable”

The European Union intends to decarbonize the building sector by 2050. Investment in retrofit could benefit the EU by up to EUR 175 bn per year. One of the biggest challenges for the reduction of GHG emissions results from the poor energy efficiency of existing buildings and still too low refurbishment rates in virtually all member states of the European Union. The reduction of the EU carbon footprint requires a significant increase of energetic retrofits in the existing property stock. The reduction of carbon-risk factors associated with premature obsolescence and potential depreciation due to changing market expectations and legal regulations are key objectives of the EU-funded research project CRREM (Carbon Risk Real Estate Monitor). CRREM aims at supporting the industry to tackle these risks and foster investments in energy efficiency as many assets will become ‘stranded’ properties that will not meet future energy efficiency standards and whose energy upgrade will not be financially viable

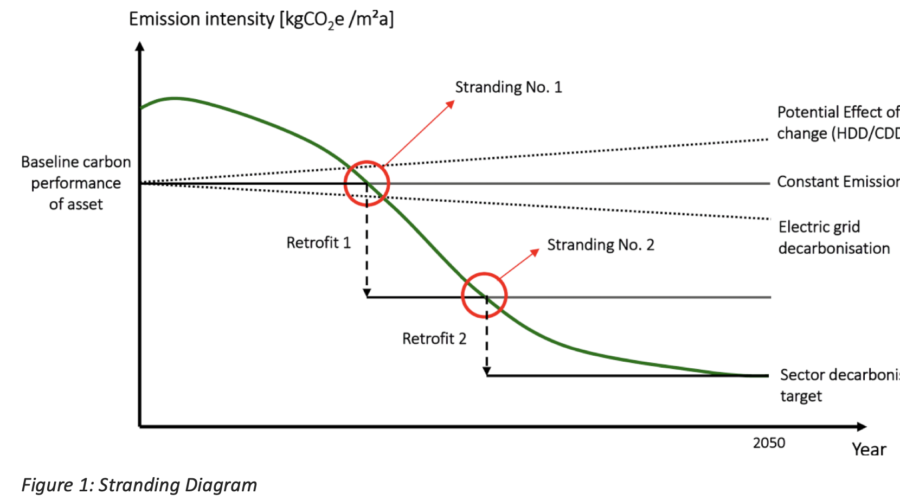

‘Stranding diagram’: The figure above provides a summary of the fundamental principle of CRREM’s stranding risk analysis approach for single properties:

● Black line: The black line represents a building’s baseline and future carbon performance in terms of the so- called greenhouse gas (GHG) intensity, which is calculated as the amount of annual greenhouse gas emissions per building floor area. Emission figures include those directly generated by the on-site combustion of fossil fuels for heating and indirect emissions (caused by the use of district heating and/or electricity consumption).

● Green curve: The green curve represents the target decarbonisation pathway of a specific building type in a specific country that aligns with a certain climate target (1.5°C/2°C) and must not be exceeded if a property intends to be “Paris-proof”. If the emission intensity is above the target value, “stranding” occurs. In that case the asset would have a carbon-footprint that is above the fair-share derived by downscaling the carbon budget to property level.

In the illustration above, the exemplary building fulfils the requirements only at the very beginning and faces stranding far before the end of the observation period (in 2050). Only appropriate retrofit measures reducing the GHG emissions can ensure that the building will meet the future emission ceilings. This might include changing the energy source (to renewables), decarbonization of the electricity grid and/or simply reducing consumption due to lower demand or due to higher insulation.

The property industry is accountable for about 38% of energy consumption and 29% of all GHG emissions in the EU and therefore plays a crucial role in EU decarbonization efforts stated in INDCs (Intended Nationally Determined Contributions). Ambitious renovation policies could reduce the demand by up to 46% between 2021 and 2030 (European Commission, 2014). For improving the energy consumption of properties, the real estate industry has to increasingly address the mitigation of direct and indirect emissions resulting from the construction phase of new buildings or refurbishments, and where applicable, from the dismantling at the end of the economic useful life. Due to the low refurbishment rates in the existing European stock and the specific requirements due to climate change, any increase of energy efficiency requires more energetic retrofits in the existing property stock to reduce the carbon footprint.

“Climate change will affect the building sector because of the reduction of their quality and value”

Climate change poses serious threats to sustained economic growth and poverty reduction, quality of life and political stability in the world. It is considered that the warming process will affect sea levels and the existence of more frequent natural disasters such as floods, storm or tornadoes, which impact on the quality and maintenance of buildings and infrastructures. The higher temperature levels will change the way of life, commerce and the configuration of urban areas. Climate change and strengthened regulation will require particular retrofitting measures that have an effect on current investment decisions. Risks and uncertainties must be adequately understood, and measures are taken to identify incentives to markets that are clear, long-term and credible, given the relevance of the private sector in the process of stopping climate change

“Offer to the Real Estate companies a tool to measure the risk and viability of retrofitting their assets”

Climate change might endanger the business case of real estate companies if no measures to transform the property stock under management are taken. Therefore, a stronger focus on climate change risk management is essential. A company strategy and risk management must ensure that individual efforts to mitigate CO2 within their portfolio must be sufficient to fulfill EU targets – otherwise the market participant might face a situation where properties do not meet future market expectations and therefore will be exposed to write-downs (we call this the risk of “Stranded assets”). CRREM aims at developing a tool that allows investors and property owners to assess the exposition of their assets to stranding risks based on energy and emission data and the analysis of regulatory requirements. By setting science-based carbon reduction pathways, CRREM faces the challenge to estimate risk and uncertainty associated to commercial real estate de-carbonization, building a methodological body and empirically quantify the different scenarios and their impact on the investor portfolios.

Classifying Funds

Article 8/9 funds and what it all means for your assets.

- Is the property asset net zero ready or MEES compliant? If no, what will the associated costs be to retrofit, this cost+ will then be deducted from offer price for additional risk to the new buyer meaning your clients sale price will likely be impacted.

- Since March 2021, asset managers (as well as players in the financial markets) must classify their funds (or other investment products) depending on their sustainability purpose, in order to ascertain which reporting obligations to fulfil under the Sustainable Finance Disclosure Regulation.

- If the building asset has robust ESG information in place, this will help an ESG focused purchaser to access cheaper ESG linked debt or equity facilities. Cheaper funding as a result of ESG performance means the investor can afford to pay higher multiplier for the building and have their fund investment committee approve the acquisition easier (as it complies with their ESG agenda such as SFDR Article 8 or 9 green funds).

- An Article 8 Fund under SFDR is defined as “a Fund which promotes, among other characteristics, environmental or social characteristics, or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices.”

- An Article 9 Fund under SFDR is defined as “a Fund that has sustainable investment as its objective or a reduction in carbon emissions as its objective.” There are a number of different requirements for Funds that promote a sustainable investment objective

7 Key Actions

1.Keeping up with the latest changes in ESG: Helping you make sense of ESG acronyms

TCFD, SFDR, Eu Taxonomy, Climate Risk Assessment, Green Finance, Article 8/9 funds and what it all means for your assets.

2. Health and wellbeing in real estate

Humans spend 90% of our time indoors. Buildings should promote health and wellbeing. Certifications like WELL and Fitwel can support human health indoors and add value to your real estate.

3.Net Zero Carbon: futureproofing your commercial assets

Provide advice on key considerations to make and features to incorporate when designing and refurbishing your commercial assets to achieve net zero carbon.

4.Developing your ESG strategy: through acquisition and beyond

Understanding key options for Net Zero Carbon at the technical due diligence stage when buying or selling assets.

5.An overview of net zero, BREEAM, WELL, LEED, Fitwel and EPCs

There are various sustainability certifications you can look to achieve and help you to understand which can work best for portfolio, fund and your assets.

6.Getting EPCs right

We take you through the governance that matter and the items that don’t when you need to refurbish and improve your EPC to achieve value for money.

7.ESG audit reports at purchase and sale

Since March 2021, asset managers (as well as investors in the financial markets) must classify their funds (or other investment products) depending on their sustainability purpose, in order to ascertain which reporting obligations to fulfil under the Sustainable Finance Disclosure Regulation.

Further Information & Client CPD

Further Information & Client CPD

Should you need me to come into your offices and provide an updated CPD or teams call CPD on this important topic or provide a competitive proposal for EPC+1 Budget Costings & Net Zero Carbon Pathway Reports please do contact by email Jason.antill@presurveyors.co.uk or phone +44 (0) 7855520223

Further Information & Client CPD

Further Information & Client CPD