Running a property consultancy or Chartered Surveying firm as an SME comes with unique challenges. You’re balancing technical expertise with commercial strategy, managing client relationships while staying profitable, and navigating a sector that’s constantly shifting due to economic cycles, regulatory changes, and evolving client demands.

If you’re building or scaling your own SME in this field, here are 15 key lessons to help you avoid pitfalls and maximise success.

1. Cash Flow is King – Manage It Relentlessly

In professional services, revenue often lags behind work completed. Clients may delay payments, disputes can arise, and large invoices don’t always mean immediate cash in the bank. To safeguard your business:

- Set clear payment terms upfront (consider staged payments for larger projects).

- Don’t be afraid to chase overdue invoices late payments can cripple an SME.

- Build a cash reserve to weather slow months.

- Avoid over-reliance on one or two major clients; if they delay, it could put your entire business at risk.

2.Hire Slow, Fire Fast Technical Skills Aren’t Enough

In surveying and property consultancy, technical expertise is vital but it’s not everything. A surveyor who lacks commercial awareness, client management skills, or attention to deadlines can cause serious problems.

- Take time to hire the right people. A bad hire can be far more expensive than waiting for the right one.

- If someone isn’t a fit, act quickly. Holding onto underperformers drains morale and damages client relationships.

3. Clients Value Relationships Over Price

If you’re constantly competing on price, you’re in a race to the bottom. Clients who choose you purely because you’re the cheapest will leave the moment they find a lower fee elsewhere. Instead:

- Position yourself as a trusted advisor, not just a service provider.

- Focus on delivering exceptional service and insights that add real value.

- Build long-term relationships repeat clients are the foundation of a stable business.

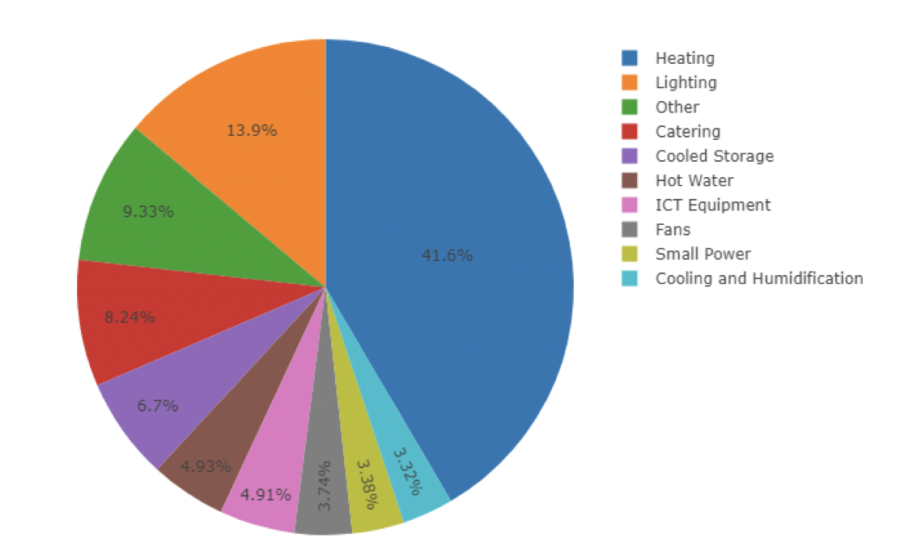

4. Diversification Protects Against Market Downturns

The property sector is cyclical. If your business only offers one core service, you’re vulnerable to market shifts. For example:

If commercial leasing slows, refurbishment projects may increase.

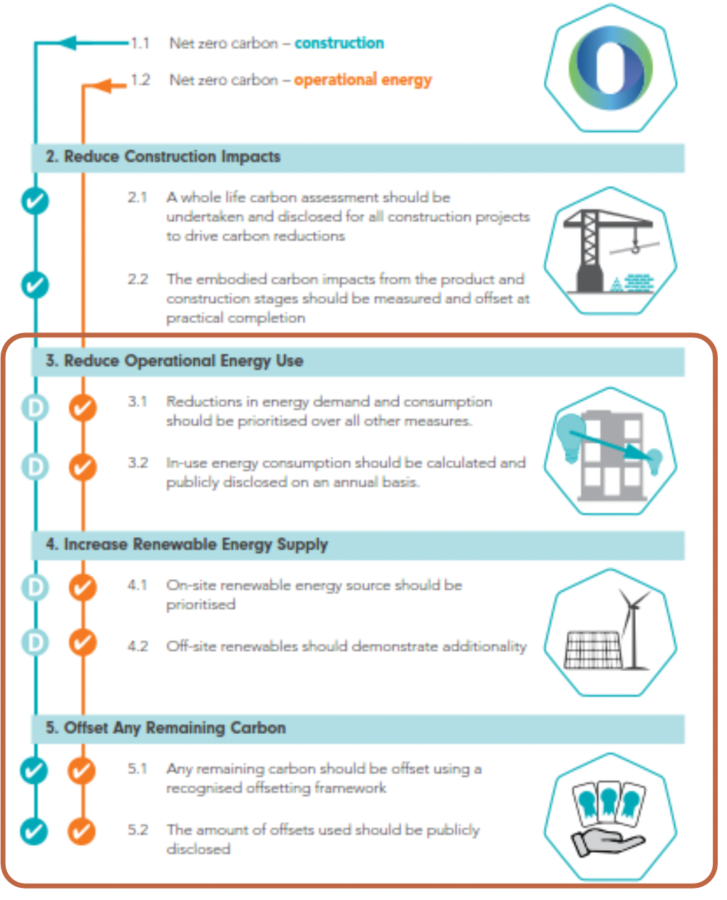

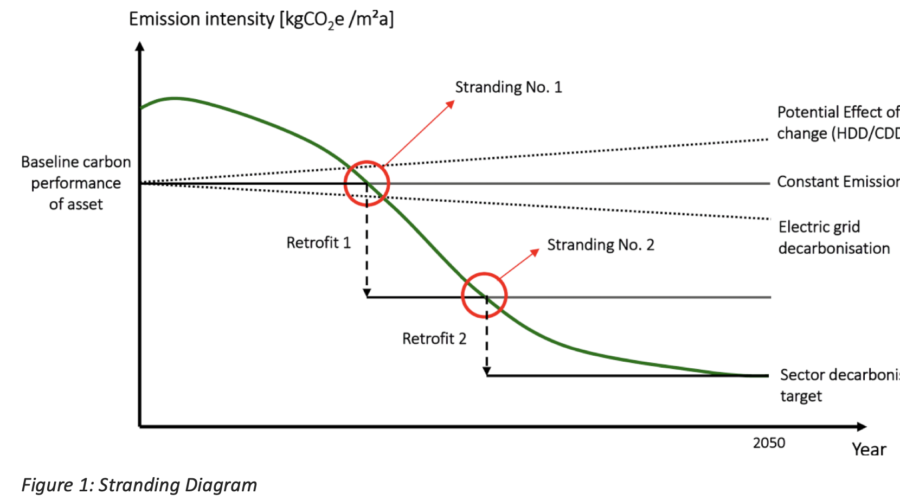

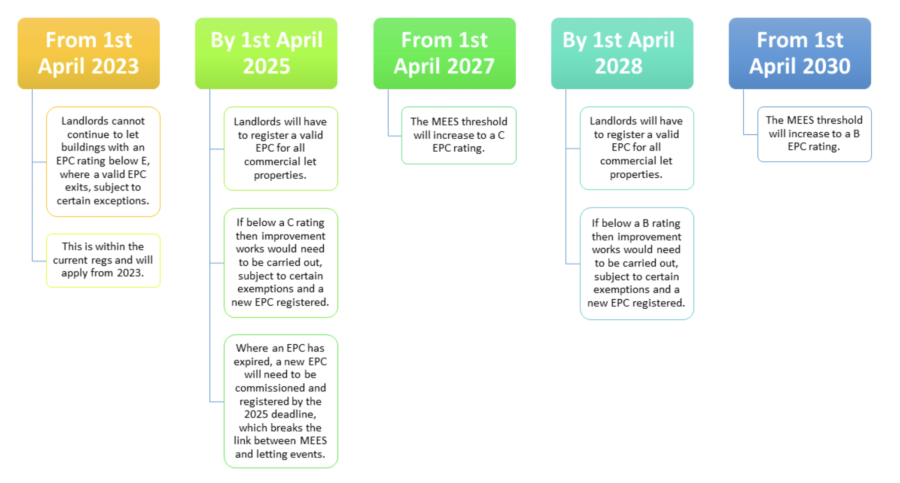

- ESG and sustainability services are growing as regulations tighten.

- Measurement, project management, and development monitoring can provide alternative revenue streams.

- Expanding your services strategically ensures that when one area dips, another can sustain your business.

5. Economic Shocks Will Happen – Build Resilience

Whether its Brexit, Covid, or a property market crash, external factors will test your business. You cant predict the future, but you can prepare for uncertainty:

- Keep overheads lean dont overcommit to long-term costs you cant adjust.

- Maintain strong relationships with clients and industry contacts so you hear about opportunities early.

- Be flexible firms that adapted quickly during Covid (e.g., by embracing remote work or shifting focus) survived better than those that resisted change.

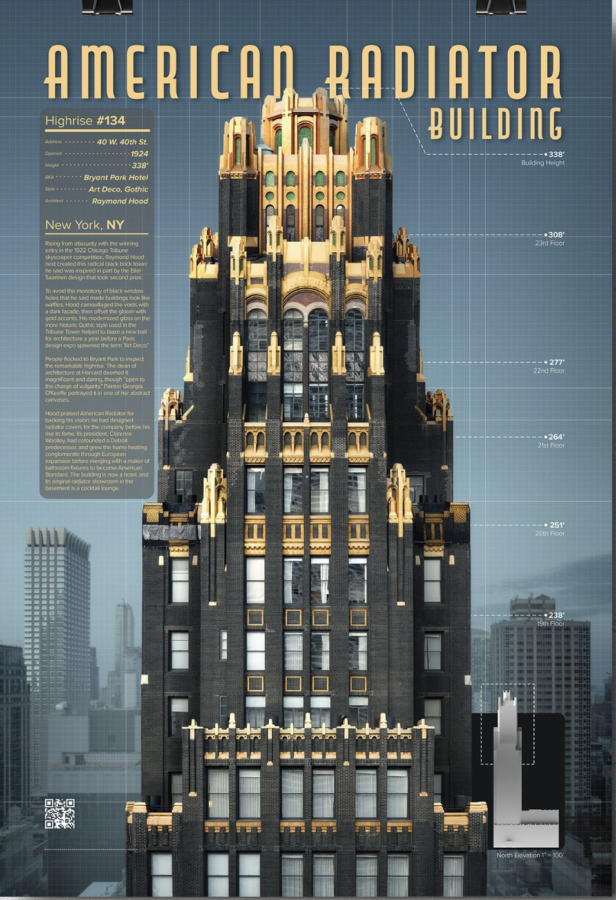

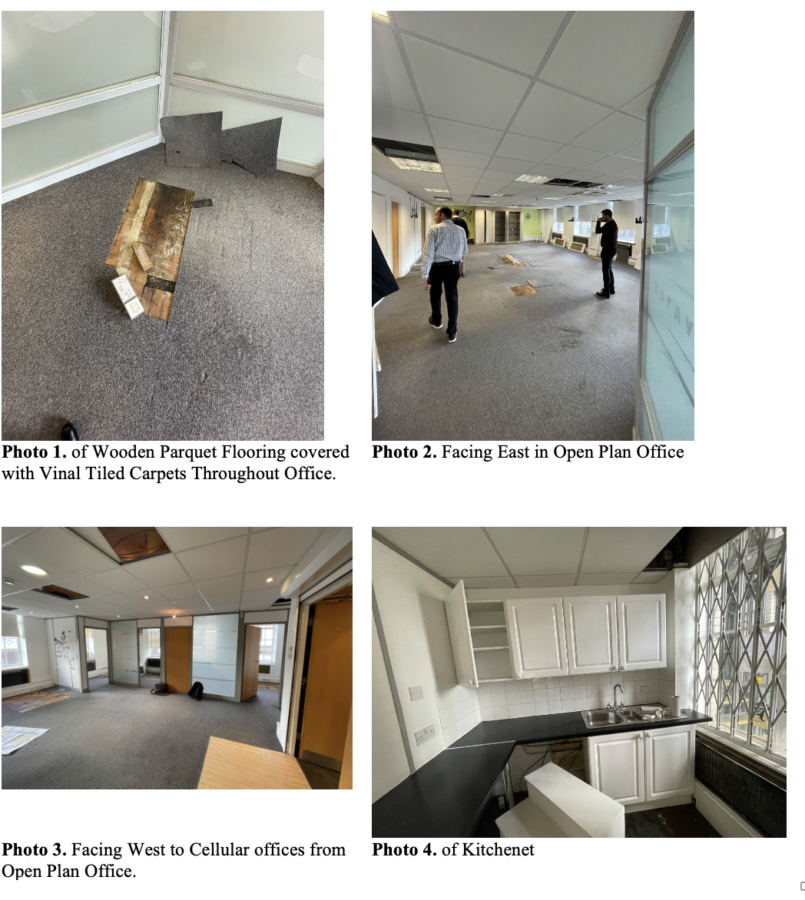

6. Office Location and Image Matter

If you’re working in commercial property, your office isn’t just a place to work it’s part of your brand. Clients take you more seriously when you’re in a central, professional environment rather than a backstreet office. However:

- Don’t overspend”your office needs to fit your business model, not just your ego.

- Consider co-working spaces in prime locations if leasing your own office is too costly.

- Your address and workspace can influence client perception and networking opportunities.

7. Work-Life Balance is a Challenge, But You Can Manage It

Surveying and property consultancy is deadline-driven, and clients often expect fast responses. If you’re not careful, the business can consume your life. To avoid burnout:

- Set boundaries with clients”urgent doesn’t mean immediate.

- Build a team you trust, so everything doesn’t rely on you.

- Take time off when you need it burnout leads to bad decisions and lower performance.

8. A Strong Core Team is Your Greatest Asset

In large firms, clients expect to deal with different departments. In an SME, they expect continuity. Your team is critical to your firm reputation and client retention.

- Invest in training and career development good people will stay if they see growth.

- Recognise that salary isn’t everything culture, flexibility, and professional challenges matter too.

- A high turnover of staff will damage relationships with clients and slow your business growth.

9. Systems and Processes Save Time and Money

In surveying and property consultancy, wasted time means lost revenue. Every hour spent on inefficient admin is an hour not billed to a client.

- Implement project management tools to track progress.

- Standardize reports and templates to reduce rework.

- Automate invoicing and follow-ups where possible.

- Efficient processes mean fewer mistakes, happier clients, and better margins.

10. Your Reputation is Everything

Property is a relationship-driven industry, and bad news travels fast. One poorly handled project, one broken promise, or one bad client experience can have long-term consequences.

- Always deliver what you promise.

- Be upfront about challenges hiding bad news only makes it worse later.

- If you make a mistake, own it and fix it.

- Your reputation will outlast any marketing campaign.

11. Networking Opens Doors You Wont Find Online

Many of the best projects never go to tender. They’re awarded through relationships.

Attend industry events, even if they don’t immediately generate work.

Join professional groups and engage in discussions.

Keep in touch with past clients they may not need you now, but they might in six months.

12. Be Open to New Markets and Opportunities

The property industry is evolving. Whether it’s sustainability, PropTech, or international expansion, staying relevant means keeping an eye on emerging trends.

- Expanding to Dubai (or other international markets) can open doors to new clients and revenue streams.

- ESG and net-zero targets are creating new demand for property-related advisory services.

- Clients want consultants who understand technology and data embracing digital tools will keep you competitive.

13. Marketing and Thought Leadership Take Time but Pay Off

Many SME consultancies rely purely on word-of-mouth, but this limits growth.

- Regular LinkedIn updates, articles, and insights position you as an expert.

- Speaking at industry events builds credibility.

- A consistent marketing presence ensures you stay top-of-mind when clients need your services.

14. Not Every Client is Worth It

Bad clients aren’t just frustrating they can hurt your business. Warning signs include:

- Constantly pushing for lower fees.

- Late or unreliable payments.

- Unrealistic expectations that lead to scope creep.

- Learn to say no to bad clients, so you can focus on the ones that add long-term value.

15. Enjoy the Journey – It’s More Than Just a Business

Running an SME isn’t just about revenue it’s about building something meaningful.

- Take time to reflect on how far you’ve come.

- Celebrate wins, no matter how small.

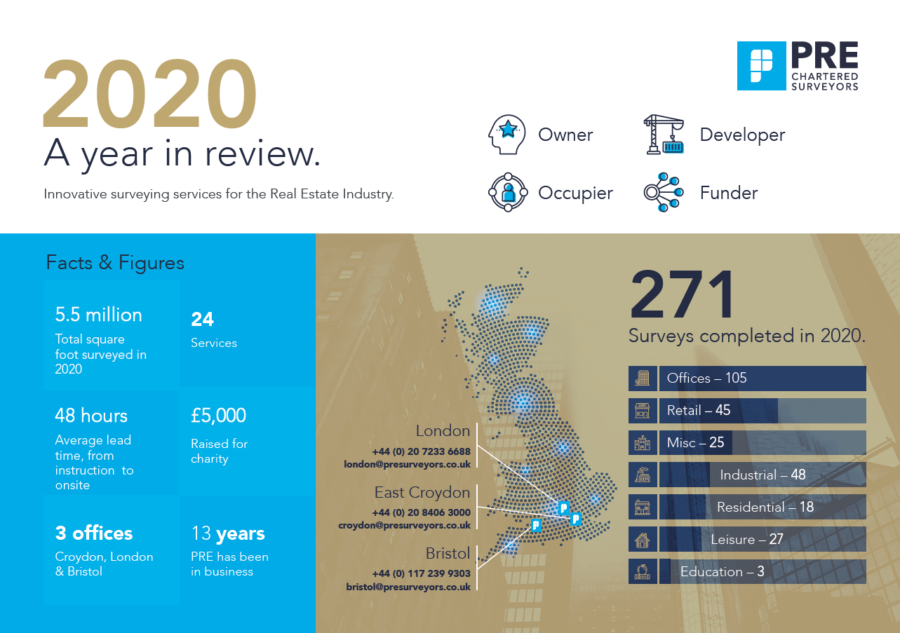

- Keep evolving 15 years ago, your business looked different, and 15 years from now, it will too.

Success in property consultancy isn’t just about financial results – it’s about reputation, relationships, and resilience. Stay adaptable, invest in the right people, and keep your business moving forward.

What’s your biggest challenge right now in growing or managing your SME?

I’m always free for a chat do get in touch for a coffee. JASON ANTILL BSc (Hons) MRICS Managing Director