Last week, we hosted another of our breakfast roundtables, bringing together a diverse group of professionals from across the built environment to explore the challenges, opportunities, and shifting trends shaping our sector. As always, the conversation was dynamic — full of insight, experience, and an appetite for tackling some of the big questions facing commercial real estate.

June’s session focused on three key themes:

- Student Housing, Co-Living and Build-to-Rent (BTR)

- Planning and Policy Levers

- End-of-Year Outlook: Forecast for the second half of 2025

Here are some of the standout insights and takeaways from our discussion.

Student Housing, Co-Living and Build-to-Rent (BTR)

Flexible, community-led living models are no longer just for students – they’re becoming the go-to option for graduates, young professionals and long-term renters looking for more than just a place to sleep.

What’s driving this shift? We believe it’s a mix of affordability pressures and a growing desire for a more service-led, hospitality style tenancy experience. It seems renters are increasingly valuing this, and landlords adopting this model are reporting higher satisfaction and stronger retention rates.

These evolving expectations are also influencing how developments are being designed — particularly in the co-living space. With rising living costs pushing people to seek better value, compact private rooms paired with high-quality shared amenities are proving a winning formula. Think gyms, lounges, social hubs and co-working areas — all built around a nurturing community, without compromising on lifestyle.

In cities like London, where affordability and space are constant challenges, co-living schemes are continuing to gain traction. Our take? When thoughtfully designed and located in the right areas, these developments continue to deliver strong returns — proving that you don’t need to sacrifice quality of life to keep things affordable. Instead, it’s about delivering convenience, community, and flexibility in one package.

That said, not everyone is rushing in. With living costs still high, some tenants (and investors) are holding back, waiting for a decrease in rental or acquisition costs before entering the market. This signals a price-sensitive climate and a watchful approach to the market.

Planning & Policy Levers

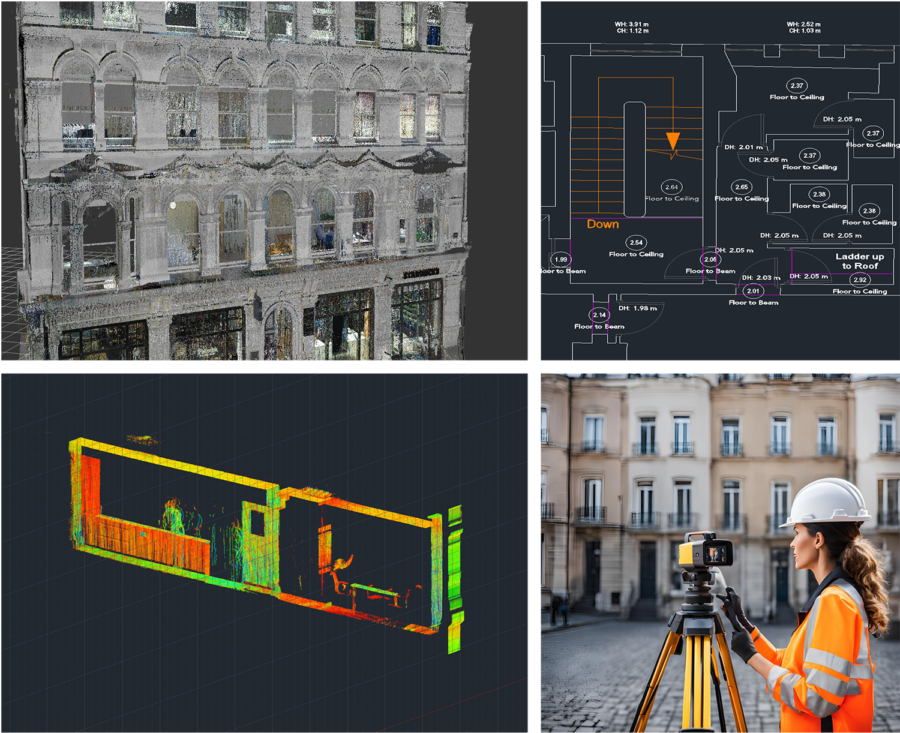

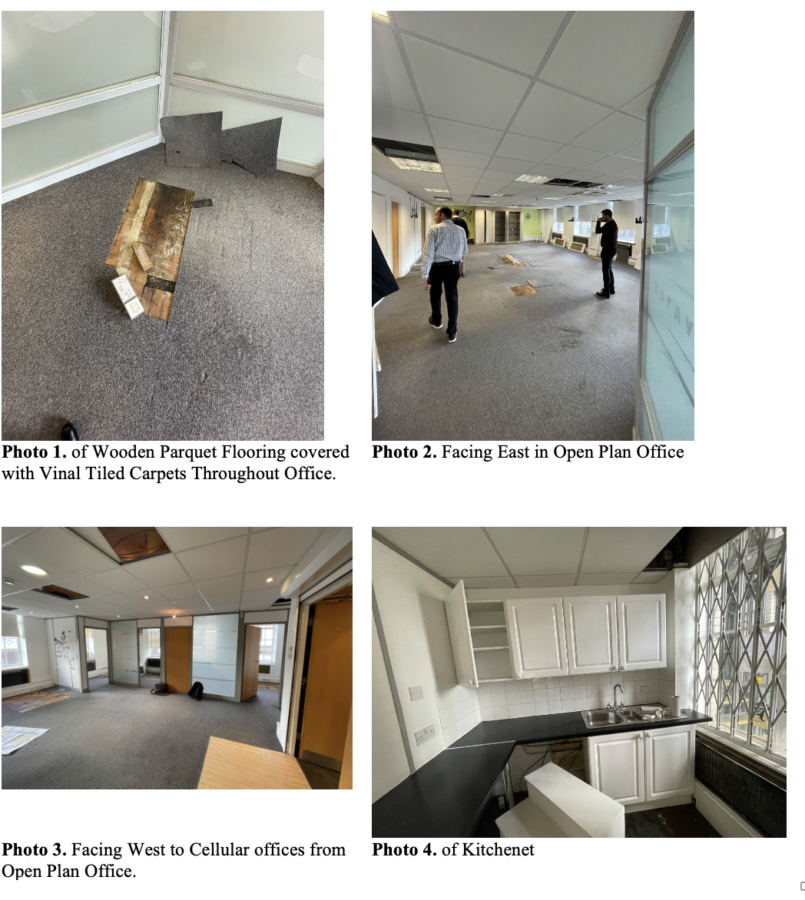

The conversation also turned to planning — always a hot topic and one that rarely offers easy answers. What was clear from around the table is that the current system is still acting as a barrier for many developers. Rigid local policies, especially those tied to use classes and density, are slowing down progress on otherwise viable sites. And for those trying to repurpose older buildings? The hoops to jump through often outweigh the benefits, which is likely why we’re seeing a growing preference for new-build schemes. They’re simply easier to get right from a compliance, sustainability, and regulatory point of view.

That said, not all planning conversations are uphill battles. The mood was that things are starting to shift — slowly, but noticeably. Planning authorities are showing more support for schemes that offer something meaningful to local communities. If a development clearly fills a supply gap or adds social value, it’s more likely to be looked on favourably. The key message – if your scheme can show how it supports the wider community, whether through better amenities, inclusive use, or public access — it’s going to stand a better chance.

We also heard some really interesting takes on how planning is having to evolve alongside changing market needs. With the high street in flux and commercial demand reshaping itself, there’s increasing recognition of the need for mixed-use developments — the kind that bring together work, living, leisure, and public realm in one place. It’s no longer just about what fits within policy constraints — it’s about what actually works for how people live and use space now.

End-of-Year Outlook: Forecast for 2025

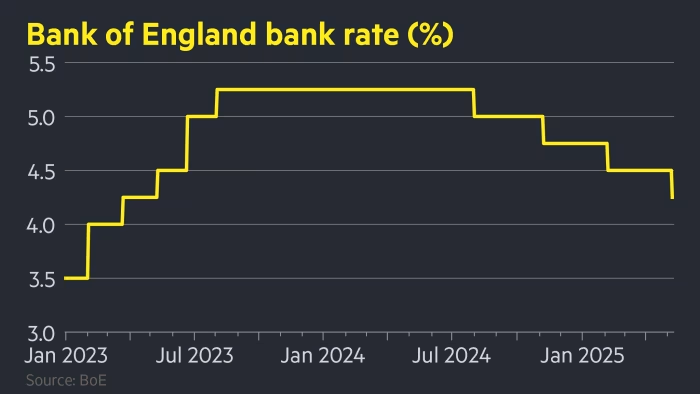

Looking ahead to the rest of the year and into 2026, a cautious optimism is emerging. While interest rates are starting to fall, valuations remain conservative and highly dependent on asset type and quality. Grade A office space is in short supply, particularly as more occupiers return to the office in earnest — often without enough desk capacity to support hybrid or fully returned teams. This is likely to drive increased demand for high-quality space that supports evolving workplace expectations.

However, funding remains a challenge. Developers are contending with high upfront costs and tighter lending criteria, which may slow the pace of delivery despite strong underlying demand.

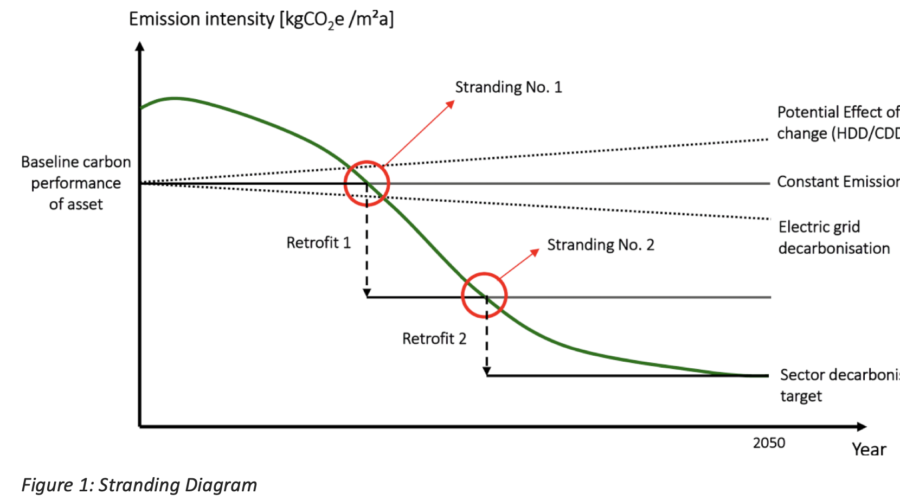

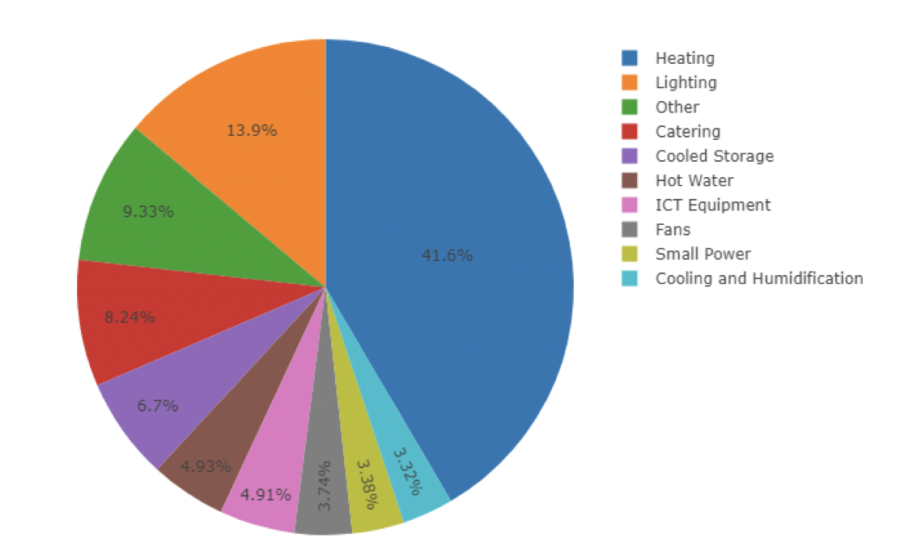

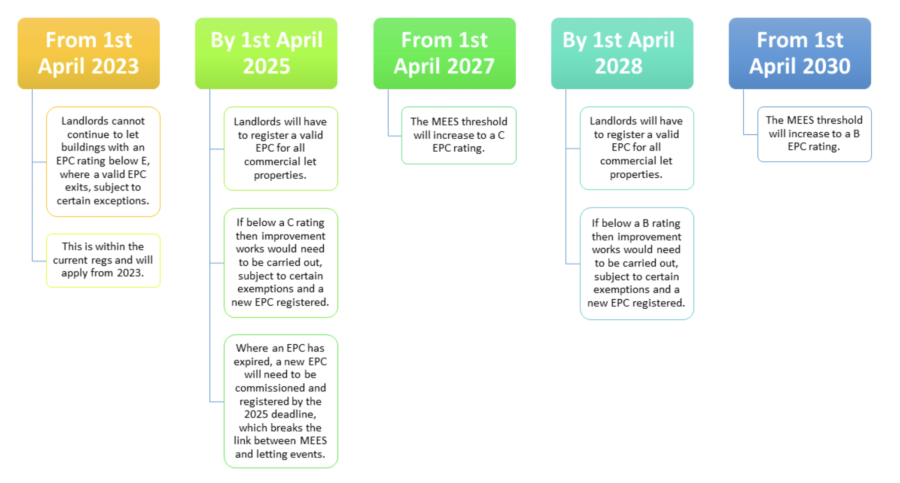

Demand is clearly shifting toward sustainable, high-spec assets. Lower-grade buildings are falling out of favour, especially as EPC requirements become more influential in leasing and purchasing decisions.

Finally, the life sciences sector continues to grow, with both major and smaller players expanding their footprint. Universities remain central to these clusters — fuelling innovation, partnerships, and demand for flexible lab and R&D space.

Thank you to everyone who joined us for a fantastic discussion. If you’re re-evaluating your assets or strategy, or want to explore new development opportunities, get in touch — we’d love to continue the conversation.