NET ZERO CARBON – SCOPE AND DEFINITION

UK Green Building Council:

“Carbon emissions from its operation, including occupant activity, are net zero on an annual basis. A net zero carbon building is highly energy efficient and powered from on-site and off-site renewable energy sources, with any remaining carbon balance offset”.

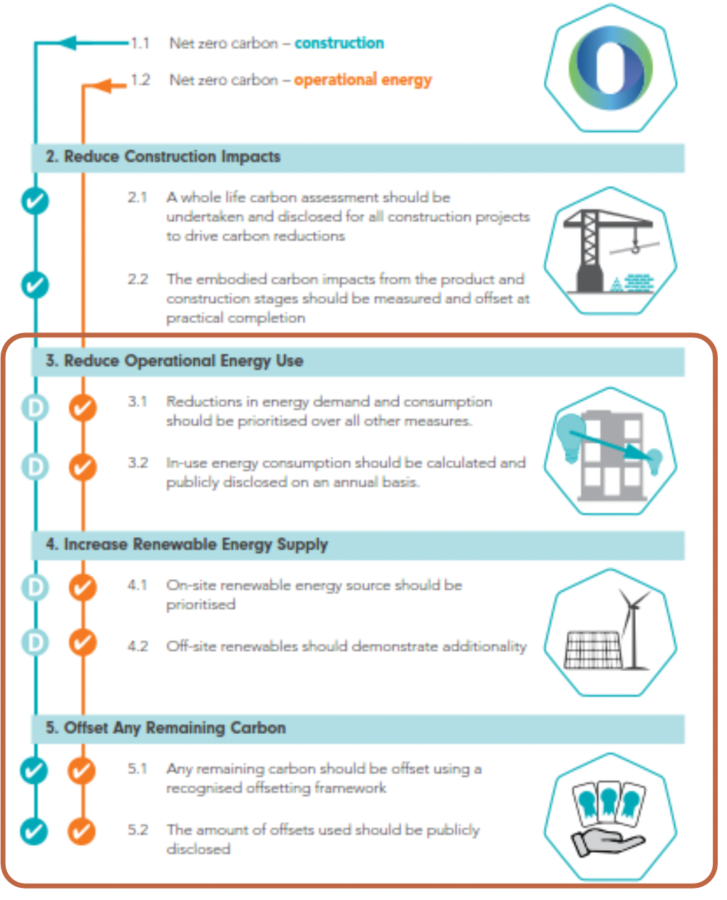

This Framework, as shown below, outlines a hierarchy to minimise energy demand and carbon emissions. The asset has been assessed under Net Zero Carbon – Operational Energy scope. The scope of the assessment is defined as “all areas under operational control that have been used to demonstrate a net zero balance”.

The four main stages of the Framework (operational) are as follows:

- As a priority, the building needs to reduce the operational energy demand as far as possible through a fabric first approach.

- The building also needs to incorporate efficient services and low carbon systems including HVAC and lighting.

- Where feasible and space allows, on-site renewable energy should be maximised, such as through on-site solar PVs.

- As a last resort, minimum carbon offsets can be used for the remaining carbon to achieve NZC. Offsetting schemes need to be procured directly or via recognised schemes including Gold standard to demonstrate additionality.

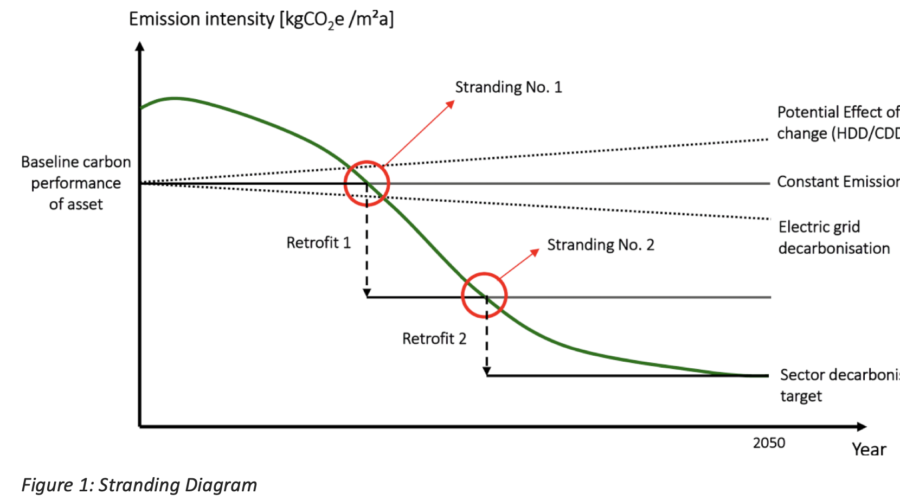

Carbon Risk Real Estate Monitor (CRREM)

About CRREM

7 Key Actions

1.Keeping up with the latest changes in ESG: Helping you make sense of ESG acronyms

TCFD, SFDR, Eu Taxonomy, Climate Risk Assessment, Green Finance, Article 8/9 funds and what it all means for your assets.

2. Health and wellbeing in real estate

Humans spend 90% of our time indoors. Buildings should promote health and wellbeing. Certifications like WELL and Fitwel can support human health indoors and add value to your real estate.

3.Net Zero Carbon: futureproofing your commercial assets

Provide advice on key considerations to make and features to incorporate when designing and refurbishing your commercial assets to achieve net zero carbon.

4.Developing your ESG strategy: through acquisition and beyond

Understanding key options for Net Zero Carbon at the technical due diligence stage when buying or selling assets.

5.An overview of net zero, BREEAM, WELL, LEED, Fitwel and EPCs

There are various sustainability certifications you can look to achieve and help you to understand which can work best for portfolio, fund and your assets.

6.Getting EPCs right

We take you through the governance that matter and the items that don’t when you need to refurbish and improve your EPC to achieve value for money.

7.ESG audit reports at purchase and sale

Since March 2021, asset managers (as well as investors in the financial markets) must classify their funds (or other investment products) depending on their sustainability purpose, in order to ascertain which reporting obligations to fulfil under the Sustainable Finance Disclosure Regulation.

Further Information & Client CPD

Further Information & Client CPD

Should you need me to come into your offices and provide an updated CPD or teams call CPD on this important topic or provide a competitive proposal for EPC+1 Budget Costings & Net Zero Carbon Pathway Reports please do contact by email [email protected] or phone +44 (0) 7855520223