News

Current and Proposed Minimum Energy Efficient Standards Regulations for Landlords

It’s important to note that some of these changes are unconfirmed and may be amended or rejected altogether. The second reading in the House of Commons is 18th March 2022. Below we will clearly differentiate between what is confirmed MEES regulations and what is proposed.

We are keeping an eye on movements and updates for these regulations and will keep both our website and this document updated as and when we have more information or confirmed news.

The Reasons

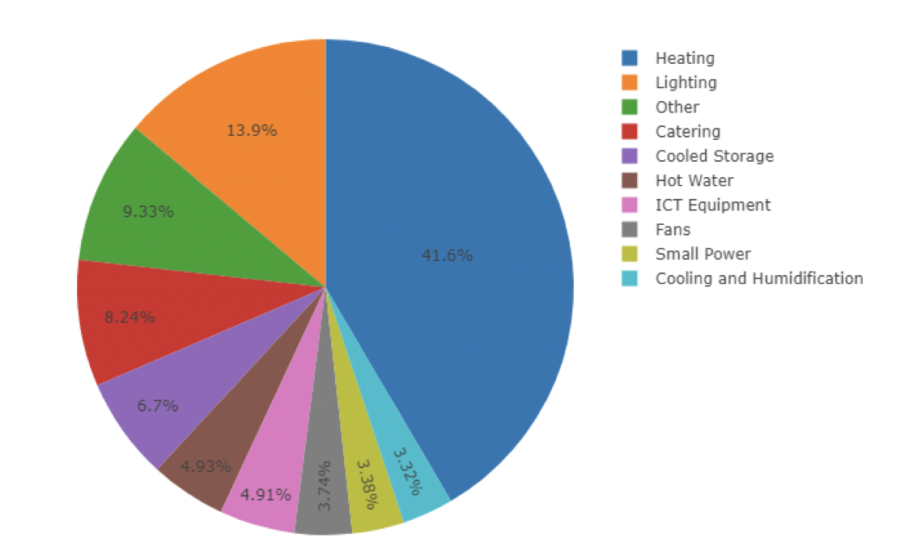

In 2014 the government reported that around 40% of the UK’s carbon emissions come from the built environment, largely through heating, cooling, lighting and providing hot water for buildings. Following this, in 2019, the UK became the first to set a net zero greenhouse gas emissions goal to be achieved by 2050 – this superseded the previous target of reducing emissions by 80% in comparison to levels measured in 1990.

The ambitiousness of this target requires that all sectors work to lower their own emissions to help the UK achieve their goal. Only approximately 15% of the current building stock in the UK was built after 1990, which is when standards for insulation and energy efficiency were brought in, and therefore the majority of homes will require improvement work to bring them to the standard needed to achieve net zero emissions.

As part of their action plan to guide the UK toward the 2050 target and address fuel poverty* the government has an aim to upgrade all homes to EPC rating grade C by 2035 which, in theory, would significantly decrease both carbon emissions and cost of heating the home. Currently, the average EPC rating for domestic properties is a D rating although the minimum requirement for rental properties is an E rating. According to a Department for Business, Energy & Industrial Strategy report the annual running cost of a C rated home is £650 less than an average E rated home.

*Fuel poverty is defined as a property that has heating costs above the national median when meeting these costs places the household below the poverty line.

Current

Current MEES Regulations 2018 require domestic and commercial properties in England and Wales to comply with certain standards before they can legally rent them out.

Domestic

Landlords cannot grant new tenancies or continue to let via existing tenancies if the property has an EPC rating of F or G.

All domestic landlords are required to comply with this if their property is legally required to have an EPC and is an assured, regulated or domestic agricultural tenancy.

A domestic landlord may apply for an exemption if they’re unable to improve the property to an E rating for an acceptable reason, often requiring a draft EPC and MEES report to demonstrate this when applying to the PRS Exemptions Register.

A local authority can serve a financial penalty if they find out a property is or has been in breach of MEES Regulations up to 18 months after the breach and/or publish details of the breach for at least 12 months*. They can decide the level of penalty, up to the following limitations as set in the MEES Regulations:

● Up to £2000 and/or a publication penalty for letting a non-compliant property for less than 3 months.

● Up to £4000 and/or a publication penalty for letting a non-compliant property for 3 months or more.

● Up to £1000 and/or a publication penalty for providing false or misleading information on the PRS Exemptions Register.

● Up to £2000 and/or a publication penalty for failure to comply with a compliance notice.

The maximum total amount that a landlord can be fined per property is £5000.

Commercial

Commercial (non-domestic) Landlords cannot grant new tenancies or renew/extend an existing tenancy agreement with existing tenants if the property has an EPC rating of F or G, unless either:

● The landlord has an exemption applied on the PRS Exemptions Register; or

● All relevant energy efficiency improvements have been made (or there are none to be

made) and the rating is still below E, and this has been registered as an exemption on the PRS Exemptions Register.

An enforcement authority can serve a penalty on those who have been found in breach of MEES Regulations, and can decide to apply a publication penalty* and determine the amount of financial breaches up to the following limits:

● Up to £5000, or up to 10% of the rateable value of the property (whichever is most), with a maximum penalty of £50000 and a publication penalty for letting a non-compliant property for less than three months.

● Up to £10000, or up to 20% of the rateable value of the property (whichever is most), with a maximum penalty or £150000 and a publication penalty for letting a non-compliant property for three months or more.

● Up to £5000 and a publication penalty for registering false or misleading information to the PRS Exemptions Register.

● Up to £5000 and a publication penalty for failing to comply with a compliance notice. These are the maximum penalty amounts per property.

Publication Penalties

* A Publication Penalty means that a local authority can publish the following information on the PRS Exemptions Register:

● Details of the breach;

● The name of the landlord (providing that this is not an individual);

● The address of the property where the breach occurred; and

● The amount of the financial penalty imposed.

Confirmed Upcoming Changes to MEES Regulations

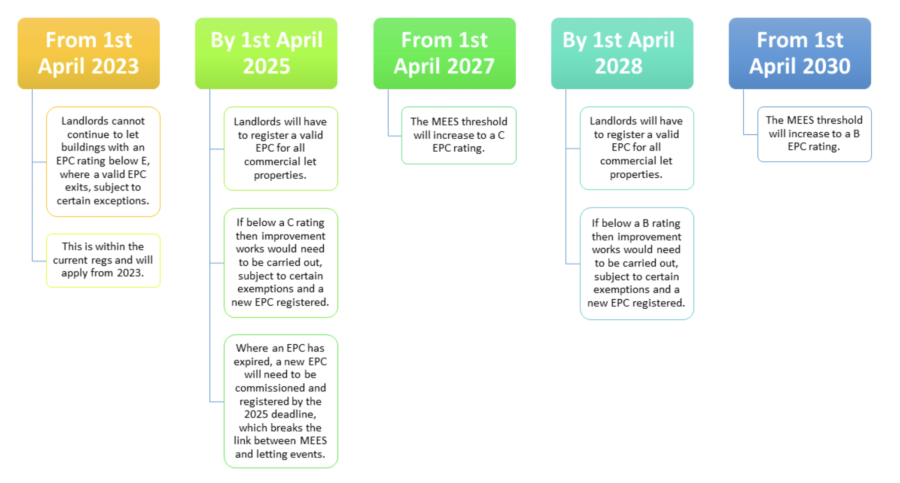

From 1st April 2023 commercial landlords will be required to comply with MEES regulations regardless of if their tenancies are existing or new. Current MEES regulations only require a E rating for new, extended or renewed commercial tenancies.

Proposed Changes to MEES Regulations

Domestic

Domestic Premises

All domestic properties regardless of tenure must achieve at least a C rated EPC by 2035, where practical cost effective and affordable, unless:

● An occupant or someone else whose permission is needed to carry out improvement works have refused permission;

● It’s not technically feasible to reach EPC band C;

● The cost of carrying out works exceeds £20000.

Privately Rented Domestic Properties

All domestic rental properties to achieve at least a C rated EPC by December 2025 before granting a new tenancy where practical, cost effective and affordable.

All existing domestic tenancies achieve at least a C rated EPC by December 2028, where practical, cost effective and affordable.

Mortgage Lenders

All mortgage lenders’ portfolios must have an average EPC rating of at least C rating by 2030.

Owner Occupied Properties – which are not mortgaged

Owner occupied homes must achieve a C rated EPC by 2035, where practical, cost effective and affordable.

Social Housing

Social landlords’ domestic portfolios must include a significant amount which achieve a C rated EPC by 2035.

New Homes

All new homes built from Jan 2025 are zero carbon ready.

Commercial

All Rented Commercial Properties

Rented commercial properties must achieve at least an EPC rating of B by 2030, unless it’s not technically feasible and where it is not cost effective.

MEES Reports

Our specialist technical team can create a comprehensive and easy-to-follow report showing you multiple scenarios for how to get your property to achieve the required ratings. Working to you and your property’s needs. This is our MEES Consultancy service.

- If we haven’t surveyed your property within the last 6 months (or if changes have occurred within the property), we will need to visit to collect the necessary data to complete an accurate report.

- Our desk based technical team will create your personalised report.

- Once you’ve completed the required works we will revisit the property to completeyour improved EPC. If the works have been completed and we can survey and finalise the new EPC within 6 months of the first appointment, we can offer a discounted revisit price.

Extensive MEES

If you need to register your property(s) to the PRS Exemptions Register then our Extensive MEES report is for you. The key difference between this and our standard style report is that this report shows what the maximum cost of installing the measure is before it becomes MEES exempt. Combined with quotes for the work from 3 sources, this can then be used as the basis of a MEES exemption application.

Exemptions

There are several categories of property that are exempt from MEES legislation , so if your property falls into these then you can apply to have it added to the MEES Exemptions Register:

- ‘High cost’ Exemption may apply in cases where the cheapest of the improvements recommended for the property would cost over £3500 to implement, as evidenced by official quotes from 3 seperate installers. This exemption only applies to domestic property.

- ‘7 Year Payback’ Exemption may apply where it can be demonstrated that the cost of energy efficiency measures required to bring the property up to standard will not pay for themselves through savings made on your energy bills within a 7 year timeframe. This exemption only applies to non-domestic property.

- ‘All Improvements Made’ Exemption may apply where it can be demonstrated that all relevant energy efficiency improvements that can be made to the property have been carried out, but the property still has an EPC rating of below an E. This exemption applies to domestic and non-domestic property.

- ‘Wall Insulation’ Exemption may apply where wall insulation is required to bring the property up to standard, but for technical reasons cavity, internal or external insulation systems are not suitable for the specific property in question. This exemption applies to domestic and non-domestic property.

- ‘Consent’ Exemption may apply where third party consent would be required to install recommended measures, such as in the case of planning permission being needed for the installation of solar panels, but consent has been refused. This exemption applies to domestic and non-domestic property.

- ‘Devaluation’ Exemption may apply where it can be demonstrated (through an independent valuation by a RICS surveyor) that installation of recommended energy efficiency measures will devalue the property by over 5%. This exemption applies to domestic and non-domestic property.

- ‘New Landlord’ Exemption may apply in specific circumstances where a person has become a landlord suddenly, such as when a new lease has been deemed created by operation of law, or a lease has been granted due to a contractual obligation. If applied for successfully this category of exemption is valid for a period of 6 months.