News

What about the Sole Directors/Shareholders Owners – Managed Ltd Real Estate companies?

We are in lockdown.

Whether the coronavirus pandemic lasts for two months or two years, the way that we live and work will be altered irrevocably

Supermarket shelves are stripped bare. Flights are grounded. Workers have been laid off; furloughed; transformed into primary school teachers. A Conservative government has nationalised the railways and is paying people not to work. And this is still only week two. In less than a fortnight, Britain has experienced the kind of social and political upheaval that normally only comes when you guillotine some royals, or storm a winter palace. But is this a brief moment of national solidarity, or a ‘new normal’?

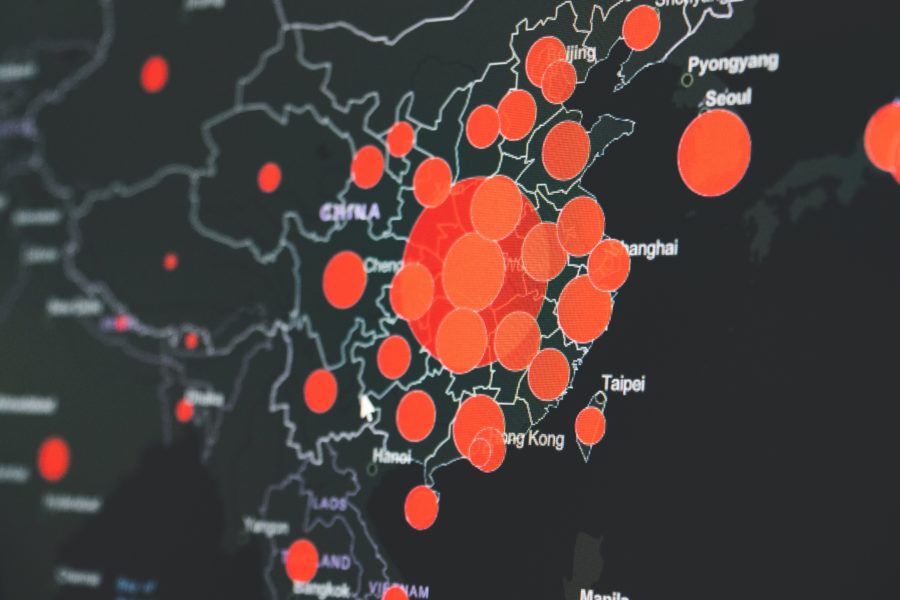

That all depends on how long the coronavirus crisis lasts. Experts believe a vaccine for Covid-19 (the disease caused by the Sars-CoV-2 virus) is still at least 18 months away, which makes Donald Trump’s promises that the US will “reopen” in three weeks seem optimistic at best. In the UK, the more likely reality was laid out in a report by researchers at Imperial College London, which estimated that elements of the new normal – social distancing, self-isolation, rolling lockdowns – could last until September 2021. So what’s likely to happen as the coronavirus crisis continues?

The reality is, nobody knows. We have never faced something like Covid-19 before and though there are analogues in the way that countries adapt to traumas like war and famine, in the global west at least, this situation is unprecedented in the modern age. Already, the impact of the coronavirus crisis on everything from the economy to social interactions to the environment has been enormous.

Lansec cancels dividend and sets up £80m relief fund for customers. Segro still paying dividends as it received 71% of expected quarterly rent. BNP Paribas guarantees staff salaries for next three months. Cushman & Wakefield make redundancies and some of the other bigger firms to include LSH, JLL & Rapleys have put some of their employees on the Coronavirus Job Retention Scheme. We understand that Savills are still paying all staff, but for how long. JLL pays their employees 2019 bonuses however Rapleys holds these back.

However what about the million sole director/shareholder owner-managed limited companies in the UK who don’t qualify as self-employed individuals (although they will complete an income tax self assessment return)?

Here are some of the most frequently asked questions about how the government’s furlough scheme applies to owner-managed limited companies.

Typically, they take some remuneration through PAYE by way of salary, usually at a level just above the NIC threshold, with the remainder taken as dividends. So can these directors make use of the Coronavirus Job Retention Scheme? The simple answer is yes, but only to the value of their PAYE salary. Dividends are not included as part of the amount that can be claimed. The other key issue is that the director must stop working completely in the business to be eligible for the scheme. We understand that statutory duties can be carried out but no services or revenue-generating work.

Based on the information published so far by the government, set out below it is our understanding of some frequently asked questions. However, we should stress that we are awaiting further guidance and therefore our comments should be seen as provisional and may change.

What can I claim?

You can claim a grant of up to 80% of your ‘regular wage’ or £2,500 (whichever is lower). This claim can be backdated to 1 March 2020. The scheme will last for at least three months.

By when does my PAYE scheme need to be in place?

The employers’ PAYE scheme must have been created and started by 28 February 2020 and you must also have a bank account in the UK. You must be on the payroll as at this date.

Can I claim if I work part-time in the business?

Yes, full-time and part-time directors on the payroll can claim.

What if my salary is paid annually?

ICAEW’s current understanding is that this should be acceptable.

What if I just reduce my hours or pay?

If the director is still working, even for reduced hours or pay, they will not be able to claim via this scheme.

How do I calculate my ‘regular wage’?

Your regular wage is the higher of the same month’s earnings from the previous year or the average monthly earnings from the 2019-20 tax year.

How to claim

You might need to take legal advice on this, but as a minimum we suggest that the company writes a letter advising the director that they have been ‘furloughed’ and a copy of this should be kept on the file to support any claim. Again, we suggest you keep an eye on government websites in case this advice changes. Wages must continue to be paid (along with tax and NI) to directors at least until the portal is up and running to make the claim for the grant at a minimum of 80% of their regular wage or £2,500 per month.

How is the grant accounted for in the company’s books?

As income subject to corporation tax.

For the latest news and guidance on the ongoing impact of COVID-19 for businesses and accountants, visit ICAEW’s dedicated coronavirus hub.