News

PRE guide to measuring and zoning retail units

PRE guide to measuring and zoning retail units

Our Services

PRE Chartered Surveyors Ltd is the UK’s leading niche Chartered Surveying firm offering specialist professional services to both landlords and tenants.

We are regulated by the Royal Institution of Chartered Surveyors (RICS).

Clients nationwide benefit from the wide ranging expertise, experience and accuracy of our in-house property teams. The ability to pick and choose from our wide range of services saves you time and cost.

Our services are tailored for your project, delivering maximum efficiency from inception to completion.

▪ Architectural

▪ Land and Environmental Surveys

▪ Building Information Modelling (BIM) & Revit Models

▪ Energy and Sustainability

▪ Area Measurement Reports

▪ PropTech

▪ Building Surveying

▪ Rights of Light, Daylight & Sunlight

▪ Project Management

▪ Professional Services

▪ Quantity Surveying

▪ Mechanical and Electrical Building Services Consultancy

ZONING AND OVERALL VALUATON METHODS

There are two principal valuation methods – the overall valuation approach and the zoning valuation approach (applied to retail shops).

Examples of the overall method of valuation are set out below: –

Overall (applying a single rate per sq ft to whole area) for GIA

Food store 50,000 sq ft @ £20 per sq ft (psf) £1,000,000 per annum exclusive (pax)

Dept Store 100,000 sq ft @ £10 psf £1,000,000 pax

Food store may be on more than one level, i.e. ground (G/F), basement (Bmt), first (F/F) and may have covered / canopied yard / loading area or plant on roof.

On GIA overall basis of valuation all main space (G/F, Bmt, F/F) valued at same rate psf but covered yard or plant at 25% or similar

Say G/F 30,000 sq ft, Bmt 5,000 sq ft, F/F 15,000 sq ft, covered loading bay 5,000 sq ft

Assume rate is £20 psf

VALUE is 50,000 sq ft x £20 + 5,000 sq ft @ £5 psf £1,025,000 pax

ZONING OF SHOP UNITS

• Retail property (other than large stores, department stores, variety stores and food stores which are valued on the overall basis) are zoned.

• Zoning as a basis of valuation is borrowed from my two valuations.

• It has been in use since the 1950’s.

• It is a total hypothetical basis of valuation because it assumes front part of shop is twice as valuable as next section, etc.

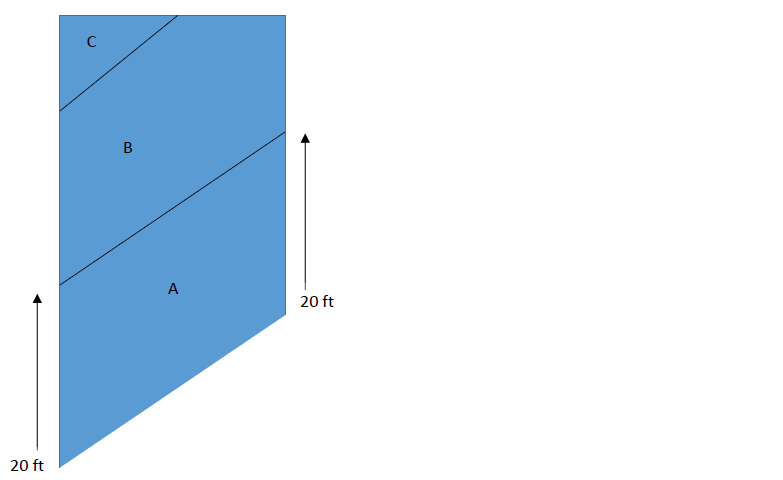

• It applies the concept of halving back whereby each zone is given a name, i.e. A, B, C, D and remainder.

• In England, 20-foot zones (except Oxford Street- 30-foot zones)

• In Scotland, 30-foot zones

• Zoning is an arithmetic tool for comparison

• Can compare ‘long thin’ shop with ‘short fat’ shop

ZONING – ZONES A, B, C etc. TO GET ITZA

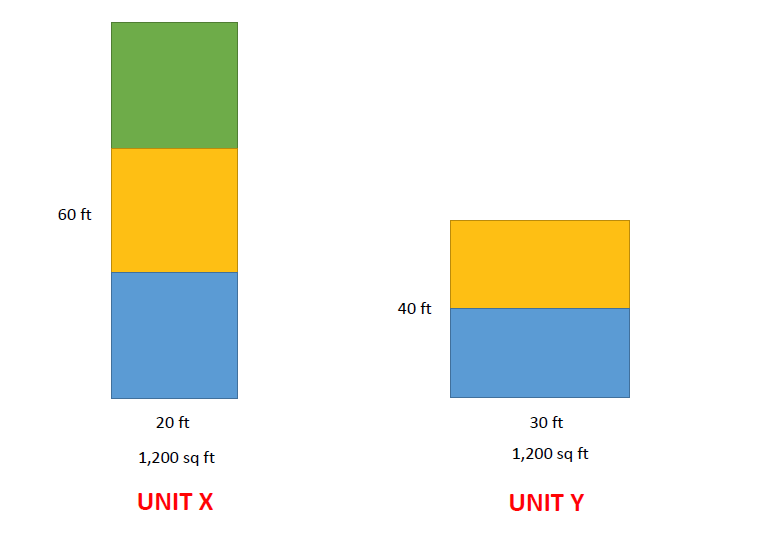

See the previous two examples of a ‘long thin shop’ and a ‘short fat’ shop.

Both are the same total size, 1,200 sq ft BUT when zoned the figures derived for these two shops, Shop Unit X and Shop Unit Y are very different.

SHOP X

ZONE A 20 X 20 = 400 X A/1 = 400 units

ZONE B 20 X 20 = 400 X A/2 = 200 units

ZONE C 20 X 20 = 400 X A/4 = 100 units

Area in terms of Zone A (ITZA) = 700 units

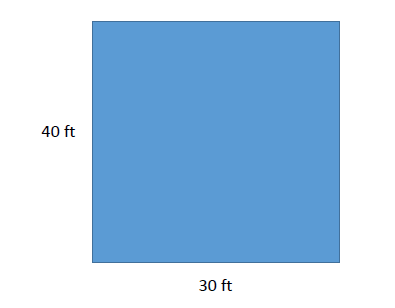

SHOP Y

ZONE A 30 X 20 = 600 X A/1 = 600 units

ZONE B 30 X 20 = 600 X A/2 = 300 units

Area in terms of Zone A (ITZA) = 900 units

VALUATION

When valuing retail shop property we express the ground floor area IN TERMS OF ZONE A (ITZA).

SHOP X and SHOP Y expressed in terms of Zone A units are as follows:-

Value Shop X ITZA 700 units x £100 = £70,000 per annum

Value Shop Y ITZA 900 units x £100 = £90,000 per annum

For convenience the ITZA figure is used when valuing a retail unit and also when devaluing the rent of a retail unit as below:-

If rent of SHOP X is £70,000 per annum what is the Zone A rate?

£70,000 + 700 units £100 Zone A

If rent of SHOP Y is £90,000 per annum what is the Zone A rate?

£90,000 + 900 units £100 Zone A

COMPOSITE ITZA’S

Retail units are often arranged on more than one level sometimes with basement, first, second, third floors etc. Each of these ancillary levels can also be expressed in terms of Zone A units such that you can derive a composite ITZA – see example below: –

G/F say 1,200 sq ft (sales) ITZA 700 units

F/F say 1,000 sq ft (stock) @ say A/20 = 50 units

2/F say 500 sq ft (staff) @say A/40 = 12.5 units

COMPOSITE ITZA 762.5 units

The composite Zone A can then be used to make valuation of retail units and devaluation of retail units much simpler- see below.

Valuation 762.5 ITZA units x £100 Zone A = £76,250 pax

Devaluation £76,250 pax / 762.5 ITZA units = £100 Zone A

MIRROR ZONING

Not all retail units have frontages which are in line with the adjoining units – some have frontages which are oblique or irregularly shaped (with pop out shop fronts).

In these cases is it customary but not mandatory to adopt what is called ‘mirror’ zoning whereby the measurements taken and the areas calculated for each zone (A, B, C etc) replicate the front Zone A so that at each of the left hand and right hand edges of the shop you measure back 20 foot (if it is a 20 foot zone) and then calculate the area of that zone doing the same in Zones B, C etc.

NATURAL ZONING

SOME SHOPS HAVE UNSUAL PHYSICAL CHARACTERISTICS IE. CHANGE IN FLOOR LEVEL (STEPS UP OR DOWN) IE. NARROWING OF WIDTH / PINCH POINT

In any of the above cases it may be appropriate to abandon conventional zoning in 20 foot zones A, B, C etc. on the basis that at the point at which the unusual physical characteristic is positioned within the shop that a new zone should apply at that point.

For instance, if a shop a change in floor level after say 35-foot depth you have two options:

1. Either start Zone C at 35 feet

2. Or adjust usual A/4 rate for Zone C to A/6

The natural zoning approach starting Zone C at 35 feet would be favourable to the tenant whereas the landlord would prefer to treat the first 15 feet of Zone A at normal rate (A/4) and then the remaining 5 foot of depth of Zone Cat say A/6.

FOR THE HIGHEST RENT THE LANDLORD ARGUES FOR DEDUCTION TO THE AFFECTED ZONE A ONLY

FOR LOWEST RENT THE TENANT ARGUES FOR %AGE DISCOUNT OFF WHOLE SHOP

RETURN FRONTAGE

Where a retail unit occupies a corner position it may have glazing on part of the side elevation and we refer to this as return frontage (R/F).

JEWELLERS IN PARTICULAR LIKE CORNER SHOPS WITH R/F OR SPLAYED FRONTAGE

If the returned glazed frontage runs for the entire length of the shop, then it will be appropriate to apply a percentage additional to the value of the whole shop.

Dependent on the quality of the return frontage (is it facing other retail units – does it substantially add to the prominence of the shop – is there a secondary entrance from the return frontage elevation). One might add 10% or 7.5%, 5% or 2.5% to the total rental value of the ground floor to reflect the benefit of the return frontage.

In a situation whereby, the glazed return frontage is partial (i.e. only part of the shops return frontage benefits from glazing and the rest is a solid structure an addition to the rental value should be made for the area of the shop which benefits from the glazed frontage). So, for example, if the first 10 feet of Zone A had a glazed return frontage then an addition of 10% / 7.5% / 5% / 2.5% would be added to the first 10 feet only.

When negotiating for a landlord or for a tenant in relation to the value (or otherwise) of return frontage the following positive arguments could be advanced – R/F increases prominence of the shop – customers can see inside the shop thus enhancing the tenant’s opportunity to attract more customers – the tenant has a greater opportunity to display their wares.

The negative arguments would be: –

– Most retailers now seek the maximum amount of linear wall space and so do not want a glazed return frontage because they could not rack against that frontage and so lose linear wall space.

– The dressing of shop windows is time consuming and costly

– The insurance premises are higher for a unit with a glazed return frontage

DISPROPORTIONATE FRONTAGE TO DEPTH (FTD)

Where a shop has a large frontage but limited shop depth it will be regarded as having disproportionate frontage to depth for which an allowance (discount) might be made.

REMEMBER SHOP Y- Frontage 30ft Shop Depth 40ft – ITZA 900 units

Is it really worth £90,000 pax when SHOP X (700 ITZA) is only £70,000 pax?

Does SHOP Y have FTD, i.e.. is it penalised by the Zoning method of valuation?

SHOP Y – Ratio 1:1.5 (Whereas SHOP x 20 x 60 is ratio 1 :3)

% age of ITZA to total G/F SHOP X is 58.33% (700 /1,200)

% age of ITZA to total G/F SHOP Y is 75% (900/1 ,200)

If FTD applies, then make an allowance (discount)

Say 10% for FTD so true rental value of SHOP Y is £81,000 pax

ALLOWANCES (DISCOUNTS & ADDITIONS)

We refer to all adjustments (discounts/additions) as allowances.

Allowances can be made for any variation from the norm.

PHYSICAL issues- R/F, FTD, Quantum, irregular shape, hard frontage

LEASE issues – restrictive user, restricted alienation, long lease term

There is case law on every issue & evidence to support/undermine